Budgeting can feel overwhelming, especially with rising living costs and the juggling act of daily bills, wants, and saving for the future. The 50-30-20 Budget Rule is a straightforward and flexible method to manage money that fits almost any income level and lifestyle.

This post walks through how the 50-30-20 rule works, real Canadian examples, budgeting tips, common questions, and how to make this rule work for you—whether you’re fresh out of college, a working professional, or planning for retirement.

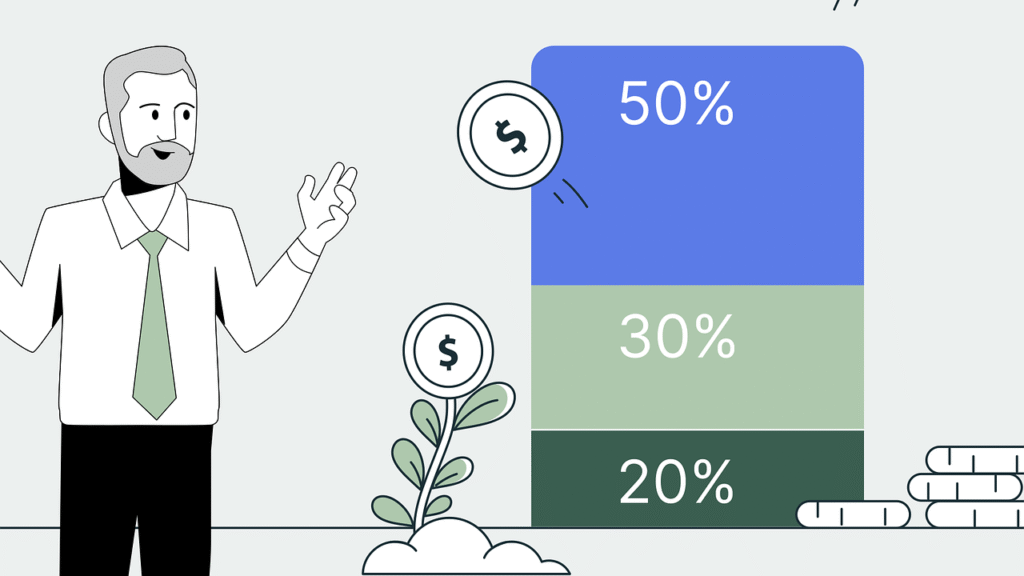

Quick Answer Box: 50-30-20 Budget Rule in a Nutshell

| Budget Category | Percentage of Income | What It Covers |

|---|---|---|

| Needs | 50% | Rent/mortgage, utilities, groceries, insurance, essential transportation |

| Wants | 30% | Dining out, entertainment, travel, hobbies, non-essential shopping |

| Savings & Debt Repayment | 20% | Emergency fund, retirement savings, debt repayment, investments |

What is the 50-30-20 Rule?

Popularized by U.S. Senator Elizabeth Warren and businesswoman Amelia Warren Tyagi, the 50-30-20 rule divides your after-tax income into three simple buckets: 50% for ‘Needs,’ 30% for ‘Wants,’ and 20% toward ‘Savings and Debt Repayment.’

For Canadians navigating budgets in diverse cities—whether in Toronto with high living costs or smaller towns—the rule provides clarity and discipline without expensive spreadsheets or complicated apps.

Real-Life Story: Meet Bo—Making the Rule Work in Toronto

Bo just graduated and landed a marketing job earning $3,500 after tax monthly. Initially overwhelmed by bills, he tracked his expenses for a month and realized his essential costs were just under $1,750—right on the 50% mark. He allotted $1,050 (30%) to things he enjoyed like dining and concerts, and committed $700 (20%) to building an emergency fund and paying down student loans.

Six months later, after a raise, Bo reassessed. He started carpooling to save on transit and increased his savings rate. This simple budgeting guide gave him control over his finances and confidence to plan bigger goals, like buying a condo.

Breaking Down the 50-30-20 Budget for Canadians in 2025

50% Needs: Your Essentials

Essentials are non-negotiable expenses that keep you alive and stable. They include:

- Rent or mortgage

- Utilities (electricity, water, heating)

- Groceries and household supplies

- Transportation (public transit, gas, car payments)

- Insurance (health, home, car)

- Minimum debt payments

- Childcare or education fees (mandatory)

If you find your needs are eating more than 50% of your after-tax income, this is a signal to re-examine living expenses. Maybe it’s time to downsize, shop smarter, or find cheaper alternatives.

30% Wants: Life’s Pleasures

Wants are discretionary spending—things that enhance life but aren’t necessary for survival. This includes:

- Eating out, streaming services, hobbies

- Vacations and weekend getaways

- Fashion, electronics, gadgets

- Event tickets, personal care salon visits

- Extra subscriptions and memberships

Wants help you enjoy life, but the 30% cap keeps things from spiraling out of balance. If wants consistently cross this line, consider prioritizing and trimming non-essential expenses.

20% Savings & Debt Repayment: Your Future

The magic happens in this category. Whether growing an emergency fund, clearing debt, or building a retirement nest egg, this bucket sets you up for financial health.

- Contributions to RRSP, TFSA, or other savings

- Extra debt payments (credit card, student loans, personal loans)

- Investing in mutual funds, stocks, or ETFs

- Building up cash reserves for emergencies or buying a home

Sample Budget Table for a Canadian Earning $5,000 Monthly (After-Tax)

| Budget Item | Percentage | Amount (CAD) | Description |

|---|---|---|---|

| Needs | 50% | $2,500 | Rent, groceries, insurance, transportation |

| Wants | 30% | $1,500 | Eating out, movies, hobbies, travel |

| Savings & Debt | 20% | $1,000 | RRSP, TFSA contributions, debt repayment |

| Total | 100% | $5,000 |

Real-Life Story: Jane’s Journey to Debt Freedom in Vancouver

Jane was paying $2,300 monthly for rent in Vancouver, nearly 60% of her $4,000 take-home pay. Wants like entertainment and dining added another 25%. Because debt repayments were only 15%, Jane knew she had to take charge.

She moved to a more affordable neighbourhood, lowered dining out expenses, and redirected $800 monthly to aggressively pay down student loans. Within two years, Jane wiped out credit card debt and refocused savings toward a down payment. The 50-30-20 framework gave her a clear, realistic plan for financial freedom.

Adjusting the 50-30-20 Rule for Canadian Realities

Canada’s cost of living varies widely. Sometimes 50% for needs isn’t realistic in cities like Toronto or Vancouver. You can adjust:

- Needs: 55%

- Wants: 25%

- Savings: 20% (minimum to build for emergencies and future)

The rule is flexible but aims not to break your savings habit. If needs or wants take too much, prioritize cutting wants first—your future self will thank you.

FAQs About the 50-30-20 Budget Rule

1. Is the 50-30-20 rule realistic with Canadian living costs?

Yes, it’s a guideline, not a strict law. In expensive cities, small adjustments are encouraged, but aim to never neglect the savings portion.

2. How do I calculate my after-tax income?

Check your pay stub for net pay after taxes, CPP, and EI. If self-employed, subtract taxes and business expenses.

3. How can I track needs vs wants?

Use budgeting apps or spreadsheets to log spending. Group your expenses under essentials (needs) and discretionary (wants).

4. What if I have debt?

Treat debt payments as part of the savings category. Prioritize paying down high-interest debt quickly before ramping up investments.

5. Can the 50-30-20 rule help with unexpected expenses?

Yes. Building savings prepares you for emergencies without derailing your budget.

Tips to Succeed with the 50-30-20 Rule in 2025

- Automate savings—set automatic transfers to investment or savings accounts.

- Review and adjust your budget every 3-6 months.

- Use cash envelopes for wants if you overspend.

- Challenge yourself to reduce needs expenses gradually.

- Celebrate milestones like clearing debt or reaching savings goals.

- Share your goals with your family or partner for accountability.

Call to Action: Make Your Money Work for You Starting Now!

Financial stability, freedom and peace of mind start with budgeting. The 50-30-20 rule is a perfect way to organize your finances, ensuring you cover essentials, enjoy life, and invest in your future.

Start by tracking your monthly income and expenses. Customize your budget categories and set monthly targets. Keep revisiting and refining. Almost anyone can benefit from the balance and simplicity of the 50-30-20 rule.

Visit cad.savewithrupee.com for more guides, budgeting tools, and personal finance tips tailored for Canadians.

Final Words

Whether you’re a busy professional, a growing family, or planning for retirement, the 50-30-20 budget can be your foundation to financial health. It encourages discipline while letting you live a full life with room for enjoyment and future security.

Give it a try starting this month. Small changes lead to big results — and budget peace of mind

🍁 Smarter Money Tips for Canada

Discover our guides on credit cards, loans, insurance, and savings designed for Canadian readers.

💡 Explore Canadian Guide